2022 showed a 3.4% decline in giving by Americans, only the fourth time in four decades donations did not increase year over year. Many donors are looking for guidance on how to develop a charitable giving plan for the remainder of 2023.

While the Food Bank for Larimer County enthusiastically welcomes any and all donations at any time, we also realize donors who may be more equipped to donate the highest amounts are also savvy enough to do so strategically. If you are unfamiliar with the nuances of tax planning, consult a professional you trust. We are not tax advisors, but we are able to share with you big-picture topics and concepts based on our research of what current experts are telling us.

Here are five actions for year-end 2023 you should put on your list of things to discuss with your financial advisor as we near the end of 2023.

Determine how tax benefits can help you support your goals or increase your impact.

An important first step in creating a year-end giving plan is to review the basic tax benefits or incentives available to you. The first benefit is the charitable deduction, which can reduce your taxable income if you itemize deductions. Overall deductions for donations to charities are generally limited to 50% of your adjusted gross income (AGI). The limit increases to 60% of AGI for cash gifts, while the limit for appreciated non-cash assets held more than one year is 30% of AGI. If your 2023 contribution and deduction exceed these AGI limits, the amount above limits may be carried over for up to five subsequent years.

In accounting principles, cash (and cash equivalents) is a term that refers to the line item on the balance an asset that can be converted into cash immediately. Your instinct may be to donate cash, but donations of appreciated non-cash assets held more than one year can help you give even more to charity in two ways:

- First, if you itemize deductions or take the standard deduction, you could potentially eliminate the capital gains tax you would incur if you sold the asset first and donated the proceeds. Doing this may increase your amount available for charity by up to 20%.

- Second, you may generally claim a charitable deduction for the fair market value of the asset, if you itemize, and may choose to pass on that income tax savings in the form of more giving.

Finally, if you are 70½ years and older and have a traditional IRA, you direct up to $100,000 of Qualified Charitable Distributions (QCDs) in 2023 to operating charities (excluding donor-advised funds) tax-free.§ While withdrawals from traditional IRAs are taxable income, QCDs are not.

In Colorado, A taxpayer who both makes qualifying charitable contributions AND claims the standard deduction on their federal income tax return for the same tax year can claim a Colorado charitable contribution subtraction for a portion of their contributions.

In Colorado, contributions of both money and property can qualify for the subtraction, but the contribution must be made to a qualified organization to be eligible for the subtraction. More here. The Food Bank for Larimer County IS such a qualified organization.

Consider bunching gifts to hurdle the 2023 standard deduction.

Many donors wonder how to determine how much they are able to give to charity. The amount depends on your specific financial situation, whether you have large taxable events for 2023 (see #5 below), and your desired charitable impact. Another important consideration is whether you plan to itemize or take the standard deduction.

For 2023, the standard deduction is $13,850 for single filers and $27,700 for married couples filing jointly. There also is an additional standard deduction for those 65 or older or those who are blind: this additional to the standard deduction is $1,850 if your filing status is single, and $1,500 per person if you are married and filing jointly.

If your total itemized deductions are below the above noted amounts, you may find it beneficial to “bunch” your 2023 and 2024 charitable donations together in 2023 to exceed your 2023 standard deduction. You could then itemize deductions on your 2023 tax return and take the standard deduction for 2024 taxes. This strategy may produce a larger total deduction over two years than two years of standard deductions, as shown in our bunching article.

If you think bunching donations while also giving to your favorite charities annually is an option for you, consider giving through a donor-advised fund account (private funds for philanthropy). Two or more years of charitable contributions can be made into such an account in 2023. Doing this creates a 2023 tax deduction and could potentially eliminate your capital gains taxes in certain circumstances.

Evaluate all investments to find the most tax-smart, high-impact donation.

As you consider how much you want to give to charity this year, also think about what you have to give. With help from your financial or tax advisor, this means identifying non-cash assets you own that have appreciated in value and assessing your potential tax liability if you were to sell the assets.

For instance, certain assets may have significantly appreciated over time and may result in a substantial capital gains tax burden upon sale, making them ideal assets to donate. Conversely, assets that are still in a growth phase may be better retained to continue accruing gains.

Appreciated non-cash assets to consider for donation include:

- Publicly traded securities—stocks, ETFs, mutual funds, and bonds

- Equity compensation awards

- Privately held business interests

- Private equity fund interests

- Restricted stock and IPO stock

- Real estate—residential, commercial, and land

- Fine art and collectibles

- Cryptocurrency

Decide whether to give now, later, or both.

When creating or updating your year-end giving plan, many find it helpful to segment their charitable goals two ways: strategies for the current year and for the future. This includes extending your charitable legacy beyond your lifetime.

Giving now (Current Year before 12/31/23):

Giving now allows you to witness the impact of your philanthropy in real-time, providing a sense of fulfillment and strengthening your connection to those facing food insecurity in Larimer County. Additionally, you may be able to claim an immediate charitable deduction for your donation (if you itemize), potentially eliminate capital gains tax if a donation is an appreciated non-cash asset held more than one year, and give IRA assets tax-free through QCDs if you are at least age 70½. Click here to give now.

Giving later for the future:

Legacy giving, like designating a charity as a beneficiary of your life insurance policy or retirement accounts, or establishing a charitable gift annuity or charitable trust, allows you to retain control over assets during your lifetime while ensuring your charitable intentions are fulfilled upon your death.

Lucky for you, the Food Bank for Larimer County is in partnership with FreeWill to provide a free, self-help estate planning service. In just 20 minutes, you can leave a lasting impact; one that resonates far beyond your lifetime. Click here to learn more.

Prioritize your donations based on your largest taxable event(s) in 2023.

A taxable event is any action or transaction that may result in taxes owed to the government. Common examples of federal taxable events include receiving a payment of interest and dividends, selling stock shares for a profit, and exercising stock options. Some taxable events are commonplace in our lives, and others are rare or one-time occurrences. Receipt of a paycheck or making a withdrawal from (most types of) a retirement account are both taxable events, for example.

If you experienced a large taxable event in 2023, contributing a portion of your assets can be an effective way to reduce your taxable income, offset or potentially eliminate capital gains taxes, and maximize support of your favorite charities and causes. Some scenarios where giving may reduce unexpected tax liabilities are:

- Unusual income year: Income and expenses are unusual when it is reasonable to expect that income or expenses that are similar in type and amount will arise in no more than three annual periods. Examples include bonus compensation and the sale of a home or business. In these scenarios, charitable giving can provide a valuable tax benefit. If you make tax-deductible donations to charities and itemize deductions, you may be able to reduce your taxable income or potentially offset the unexpected income taxes or capital gains taxes. This can be especially advantageous if you find yourself in a higher tax bracket due to increased earnings.

- Investment portfolio rebalancing: Rebalancing typically often involves selling appreciated assets that exceeded target allocations and buying depreciated assets that have become underrepresented in the portfolio. Selling appreciated assets will trigger capital gains income. To lessen tax liability, you can donate long-term appreciated assets to a charity instead of selling the assets. This strategy could allow you to eliminate the capital gains tax and claim a charitable deduction for the fair market value of the donated assets.

- Retirement account withdrawals:If you are over age 59½ and have tax-deferred retirement accounts, you can use charitable donations and deductions—if you itemize—to help offset your tax liability on the amount you withdraw. In addition, if you are over age 70½ and have a traditional IRA, you can use QCDs, mentioned above, to satisfy all or part of your IRA Required Minimum Distribution (RMD).

How to Give to the Food Bank for Larimer County

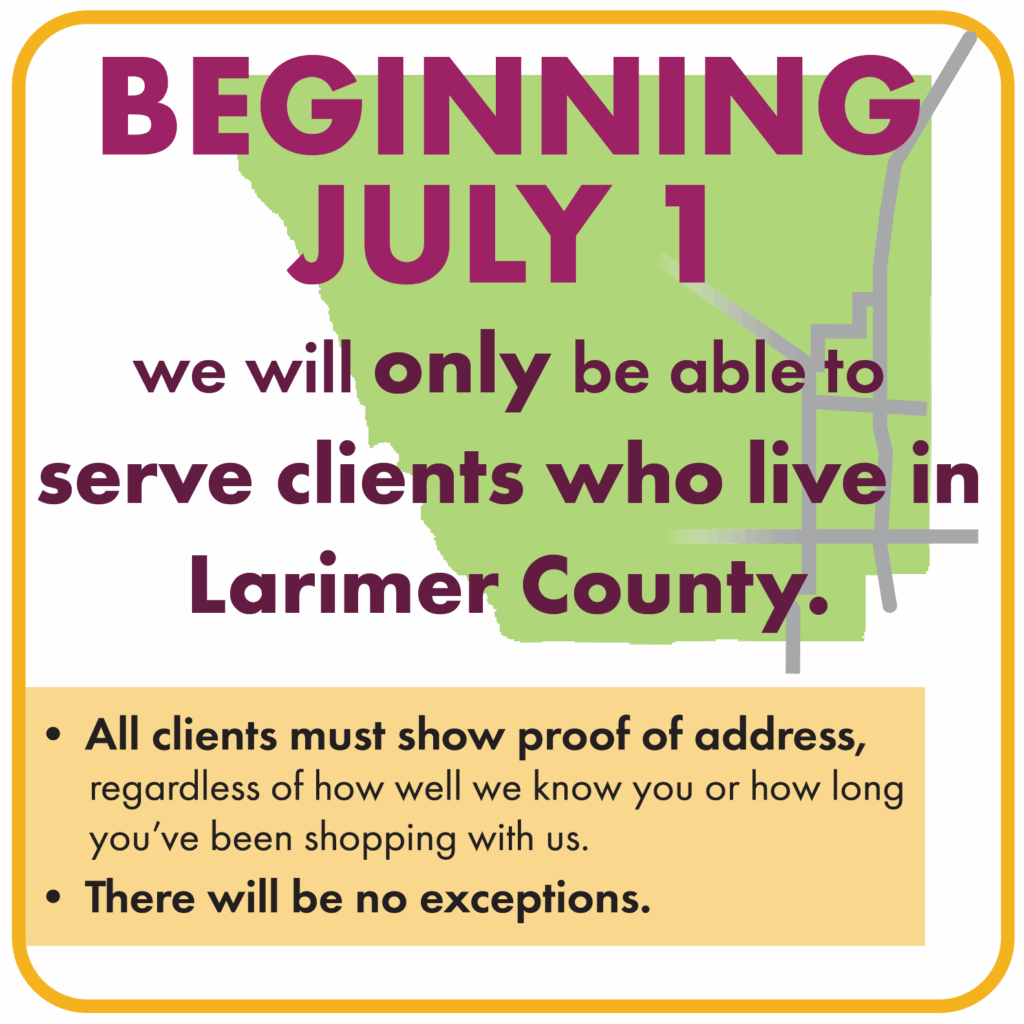

The Food Bank for Larimer County accepts both food and funds when it comes to donations. Donations of money can be set up as a one-time donation, a monthly donation, gifts of stock, or even legacy gifts (inclusion in a will or trust).

Donations of food can be given at all three FBLC locations. In addition to food for humans, we also accept pet food. Other welcomed donations include non-food items like diapers, baby wipes, deodorant, toothpaste, menstrual products, and other essentials that help our clients live healthy and rewarding lives.

^ The federal long-term capital gains tax rate is 0%, 15%, or 20%, depending on the donor’s income level. The rates do not consider any state or local taxes or the Medicare net investment income surtax.

§ Operating charities, or qualifying public charities, are defined by Internal Revenue Code section 170(b)(1)(A). Donor-advised funds, supporting organizations, and private foundations are not considered qualifying public charities.

Sources: Schwab Charitable, Investopedia, Colorado Department of Revenue Income 48, Corporate Finance Institute, The International Accounting Standards, Giving USA’s Annual Report on Philanthropy,